[precontent]

[box class=”transwht” style=”simple”]

Increase your Long Term Care Insurance

Business – Client Satisfaction – Commissions

Get the Facts about Linked Benefits

[/box]

[/precontent]

[section background_repeat=”repeat” background_position=”center top” background_attachment=”static” background_scroll=”none” padding_top=”-50″]

[space value=”-60″]

[/space]

[one_third valign=”middle” animation=”none”]

Watch this short video to learn more about when Linked Benefits could be the best solution for your client long-term care planning.

[button linking=”default” linking=”default” link=”https://ltcusa.org/linked-benefit-info-form/” icon=”” align=”center” size=”big” type=”wide” style=”solid” icon=”arrow-right” text_color=”#ffffff” bg_color=”#8ABC3C”]Get Started Now![/button]

[/one_third]

[two_third_last valign=”middle” animation=”none”]

[/two_third_last]

[/section]

[section background_color=”#23cbdd” background_repeat=”repeat” background_position=”center top” background_attachment=”static” background_scroll=”none”]

[box style=”simple”]

As the traditional LTC marketplace continues to experience rate increases, exiting carriers, and reduced benefits, Linked Benefit coverage filed as qualified long-term care under U.S. Code 7702(b) may offer your clients a better solution to leverage their wealth and protect against a long term care event. Linked Benefit coverage is NOT chronic and critical illness riders providing an advancement of the death benefit, filed as U.S. Code 101(g). Its protection that remains as an asset class within your client’s financial portfolio.

[/box]

[one_third valign=”top” animation=”none”]

LIVE CASE IN UNDERWRITING! Male age 62 and female age 61 using $100,000 single premium with $620.02 annual premium to double LTC pool:

Note: $620.02 rider premium is optional and guaranteed never to increase. Call our office for a client illustration that best meets your customer’s needs. (888) 400-1232

[/one_third]

[two_third_last valign=”top” animation=”none”]

[/two_third_last]

[/section]

[section background_color=”#7de4f2″ background_repeat=”repeat” background_position=”center top” background_attachment=”static” background_scroll=”none”]

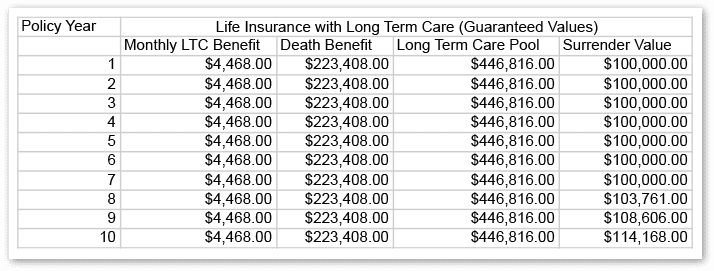

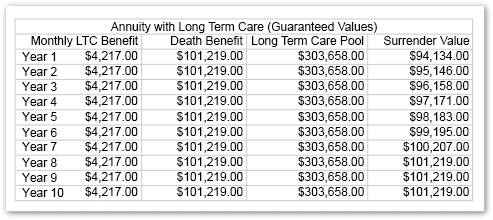

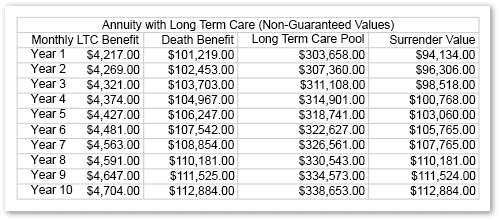

Male age 65 using $100,000 for single premium purchase of Life/Annuity:

[one_half valign=”top” animation=”none”]

[/one_half]

[one_half_last valign=”top” animation=”none”]

[/one_half_last]

[/section]

[section background_color=”#363f51″ background_repeat=”repeat” background_position=”center top” background_attachment=”static” background_scroll=”none”]

Still Don’t understand the advantage of Linked Benefits? Schedule a call with John Murray for further explanation.

[email protected] | www.ltcusa.org | (888) 400-1232

[/section]